Any eCommerce business that manufactures goods has three different types of inventory at any given time: Raw Materials Inventory, Work in Process Inventory, and Finished Goods Inventory. These three terms describe materials and goods at different stages in the manufacturing process to ensure that none are missed. This is important because inventory is considered an asset, and its value must be calculated at the end of every accounting period for financial reporting.

This article will show you the difference between these types of inventory and how to calculate Work in Process inventory.

When Does Inventory Become WIP Inventory?

If your eCommerce business makes and sells hats, for example, you purchase raw materials such as fabric, thread, leather, ribbon, etc. to make the hats. These materials are stored in a back room somewhere until they are needed. During this time they are calculated as Raw Materials Inventory in your general ledger inventory account.

As soon as they are pulled from the back room onto the factory floor (or into your hands if you’re making the hats yourself) they become Work in Process (WIP) inventory. Work in Process, much like the commonly used phrase “work in progress,” is work that has been started but is not yet finished. WIP inventory, then, is inventory that is currently being used to manufacture something. Its value includes not only the cost of the raw materials in use, but the added manufacturing costs. Ergo, when a hat is finished, its cost is added to the Finished Goods Inventory in the general ledger account and subtracted from the WIP inventory.

Why Do I Need to Track WIP Inventory?

Unless your eCommerce business is manufacturing the goods you sell, you probably won’t need to calculate WIP inventory. Most eCommerce businesses outsource their manufacturing process to a third-party manufacturer. The manufacturing company purchases the raw materials, manufactures the goods, and sells finished products to wholesalers, retailers, or eCommerce businesses that order the goods. The manufacturing company does need to keep track of WIP inventory for its own accounting purposes.

It is helpful for all eCommerce businesses to understand the calculations however, because those raw materials and manufacturing costs are factored into the price you pay for finished goods.

Inventory is usually your largest asset, and one of the factors used to calculate Cost of Goods Sold (COGS) and establish your margins. If your product is highly customized, you’ll want to make sure your manufacturer is doing all it can to minimize manufacturing costs. If not, you have the option to find another supplier or manufacturer.

How to Calculate Inventory Assets

Whether you produce your own goods in-house or outsource manufacturing, inventory is considered an asset when reporting financials at the end of the year. That means your accounting team needs to calculate how much cash is tied up in inventory at the end of every accounting period.

For an eCommerce business, inventory may simply be the finished goods purchased from a manufacturer. For a manufacturing company, all three types of inventory are considered assets and must be calculated separately to arrive at a total. The manufacturer needs to know the costs that have gone into obtaining the raw materials in storage, costs of the goods currently being manufactured, and the value of the finished goods available.

For accounting purposes, inventory costs are calculated periodically at the end of every accounting period, or constantly using a perpetual inventory system. An actual dollar value is attributed according to the cash flow method chosen by the company, whether FIFO (first in, first out), LIFO (last in, first out), or Weighted Average.

Raw Materials Inventory – includes the amount paid for all the fabric, supplies, and materials in storage, as well as the freight costs to get them to the factory, and the cost to store them once they are there.

Work in Process Inventory – includes the cost of the direct materials in production at that particular time, direct labor costs, and the portion of manufacturing overhead allocated for those materials on the factory floor.

Finished Goods Inventory – includes the COGM (Cost of Goods Manufactured) minus the COGS (Cost of Goods Sold).

Other Inventory – may include items like packaging materials.

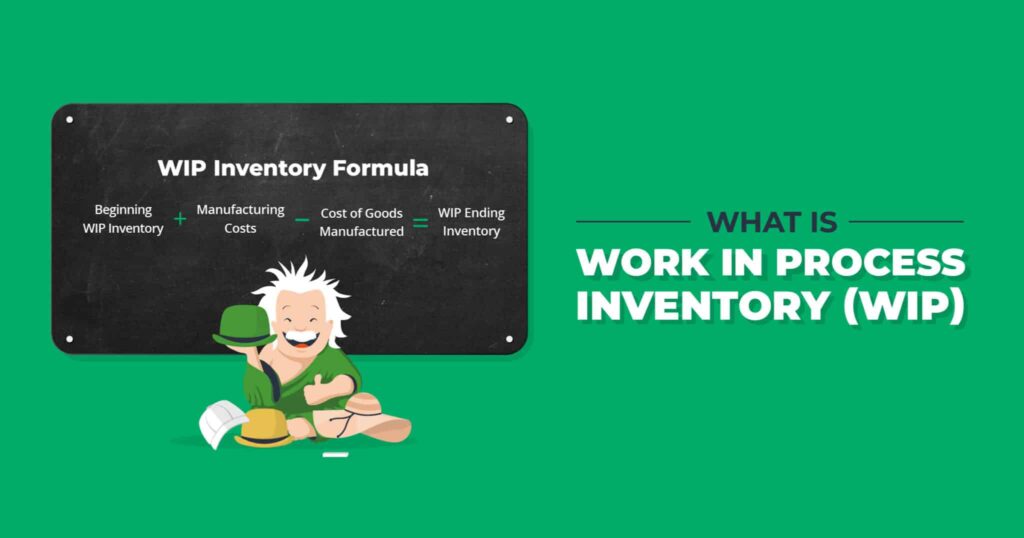

How to Calculate WIP Inventory

To calculate WIP inventory at the end of an accounting period, start with the amount that was considered WIP inventory at the end of the last accounting period (ending WIP Inventory). This becomes the beginning WIP inventory for the next period. You will then add manufacturing costs for goods currently in production, and subtract the Cost of Goods Manufactured which have been moved to finished goods. COGM includes direct materials, direct labor, and manufacturing overhead.

Direct Materials – are the raw materials that have been brought out of storage and are currently being used in the production of your “hats.” In this case, direct materials include the cost of the fabric and other materials, as well as the freight costs to get them to the factory and the storage costs once they arrive.

Direct Labor – includes the wages of the workers who are actually sewing the hats or operating the machinery.

Manufacturing Overhead – includes indirect labor such as managers, supervisors, and maintenance workers in the factory, depreciation of buildings and machinery, rent and property taxes, electricity and gas, and other indirect factory supplies.

Formula for Cost of Goods Manufactured

Cost of Goods Manufactured and WIP inventory go hand in hand. Often, manufacturing costs are estimated when products move into production, and are finalized using actual costs once they become finished goods. Once you’ve calculated COGM you can calculate WIP Inventory.

How to Calculate COGS for Manufacturers

For manufacturers, understanding how inventory costs play into manufacturing costs is all part of calculating Cost of Goods Sold. As inventory moves through the production process from raw materials to finished goods, labor and manufacturing costs are added to arrive at the total Cost of Goods Manufactured. From there, you can calculate the Cost of Goods Sold.

How to Calculate COGS for Retailers and eCommerce Businesses

For a non-manufacturing company such as a retailer or eCommerce business that purchases manufactured goods, the formula for calculating ending inventory and COGS is simpler. Raw materials and manufacturing costs are built into the price that you pay for finished goods. Once purchased, these finished goods become your merchandise, or your inventory, which is listed as the asset “Cost of Goods Available” on your company’s balance sheet.

Adding it All Up

For manufacturers, WIP Inventory is one small piece of the puzzle that helps you determine your costs, meet reporting requirements, and reconcile your balance sheet. For non-manufacturing eCommerce businesses and retailers, WIP inventory costs are often invisible—carried over into the price of the finished goods you purchase. But now that you understand what goes into calculating that cost, you know what questions to ask your manufacturer to ensure that you’re getting the best price for your goods.

Typically your 3PL or fulfillment center partner will only handle finished, post-manufactured goods. The 3PL’s inventory management system (especially in cases where your inventory is split between multiple fulfillment center locations) will give you accurate inventory counts at different times, which can be bolstered by on-demand physical counts to ensure accuracy during key accounting periods.

If you’ve struggled with managing inventory and getting real-time data like this, it may be time to switch to a tech-forward 3PL like ShipMonk that already has these features in place. Contact ShipMonk for a demo of our proprietary 3PL eCommerce fulfillment platform, and see how we can help your fast-growing eCommerce business better manage its inventory!